This post may include affiliate links.

If you make a purchase, I'll earn a small fee at no extra cost to you.

Credit unions differ from banks in important ways. See why I choose Golden 1 Credit Union with my finances at every stage of my life.

Thanks to Golden 1 Credit Union for sponsoring this article.

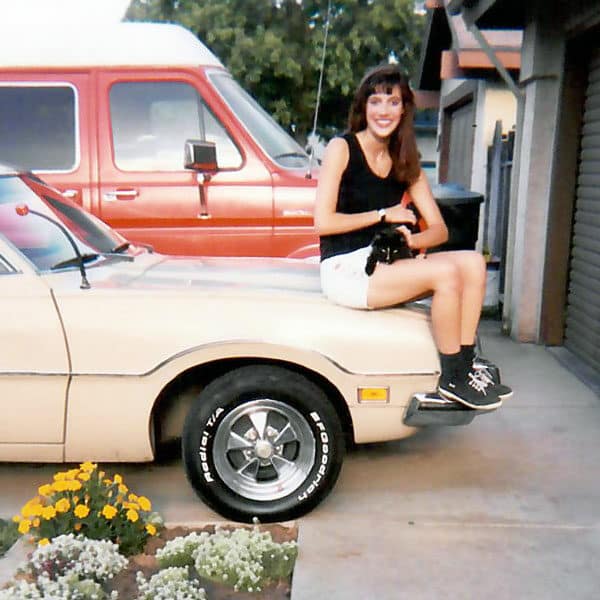

Ok, friends: it’s time to take a ride in the way-back machine. Here I am sitting on the hood of my first car.

It was a 1973 Ford Maverick and let me tell you–I was absolutely in love with that car. I put in a fancy digital stereo/cassette player, upgraded the stock rims and tires, and kept the engine (a 302 V8) running like a top.

The only drawback of having a car that was as old as I was (*cough*) is that it broke down a lot. As a starving student, I did all of my own car repairs, tune-ups, the works. I spent a lot of time under the hood of that car!

When Hubby and I got engaged, I decided to buy a new, more reliable car.

Piece of cake, right? I was working, in college–it should have been easy to get a car loan.

Well, guess what: none of the big banks would give me the time of day.

That’s when my dad suggested that I try Golden 1 Credit Union. There was a branch right next to his office, and he’d had an account there for years.

Well, the good folks at Golden 1 helped me out with a car loan way back in 1995. I’m happy to say I’m still a member all these years later, because Golden 1 Credit Union gives me better service than the big banks.

Why use a credit union instead of a bank?

Banks are for-profit entities. They’re concerned with making money for their shareholders, and that is done at the customer’s (literal) expense. Their loan rates are typically higher and interest rates are lower.

Credit unions, like Golden 1 Credit Union, are not-for-profit. This means they’re able to give lower loan rates, better returns on savings, and more free services.

Since they don’t have to make money for shareholders, they’re able to pay dividends to their members. In 2019, Golden 1 gave back more than $20 million to their members!

I also appreciate the fact that Golden 1 is part of the community and supports local charities like the Sacramento Literacy Foundation and 916 Ink, for young authors. We always want to support reading and literacy!

Golden 1 Credit Union has continued to support our family for many years, in all the stages of our lives.

In 2003, our swimming pool needed repairs. Whooo boy, that was an expensive problem. Golden 1 gave us a home equity loan that enabled us to tackle this unexpected project.

We had to drain the entire pool, repair the leaks, replace the tile, and redo the pool’s surface. It took several weeks to complete all of this (yes, Hubby did some skateboarding in the pool while it was completely empty).

It looks much nicer now, with the new finish and my garden boxes.

When it comes right down to it: why do I choose a credit union instead of a bank? Because I can rely on Golden 1 Credit Union to help us with our finances, so we can have fun!

Thanks to Golden 1 Credit Union for sponsoring this article.